The 7-Second Trick For Transaction Advisory Services

Wiki Article

The Ultimate Guide To Transaction Advisory Services

Table of ContentsA Biased View of Transaction Advisory ServicesThe Single Strategy To Use For Transaction Advisory ServicesThe Main Principles Of Transaction Advisory Services The Greatest Guide To Transaction Advisory ServicesHow Transaction Advisory Services can Save You Time, Stress, and Money.

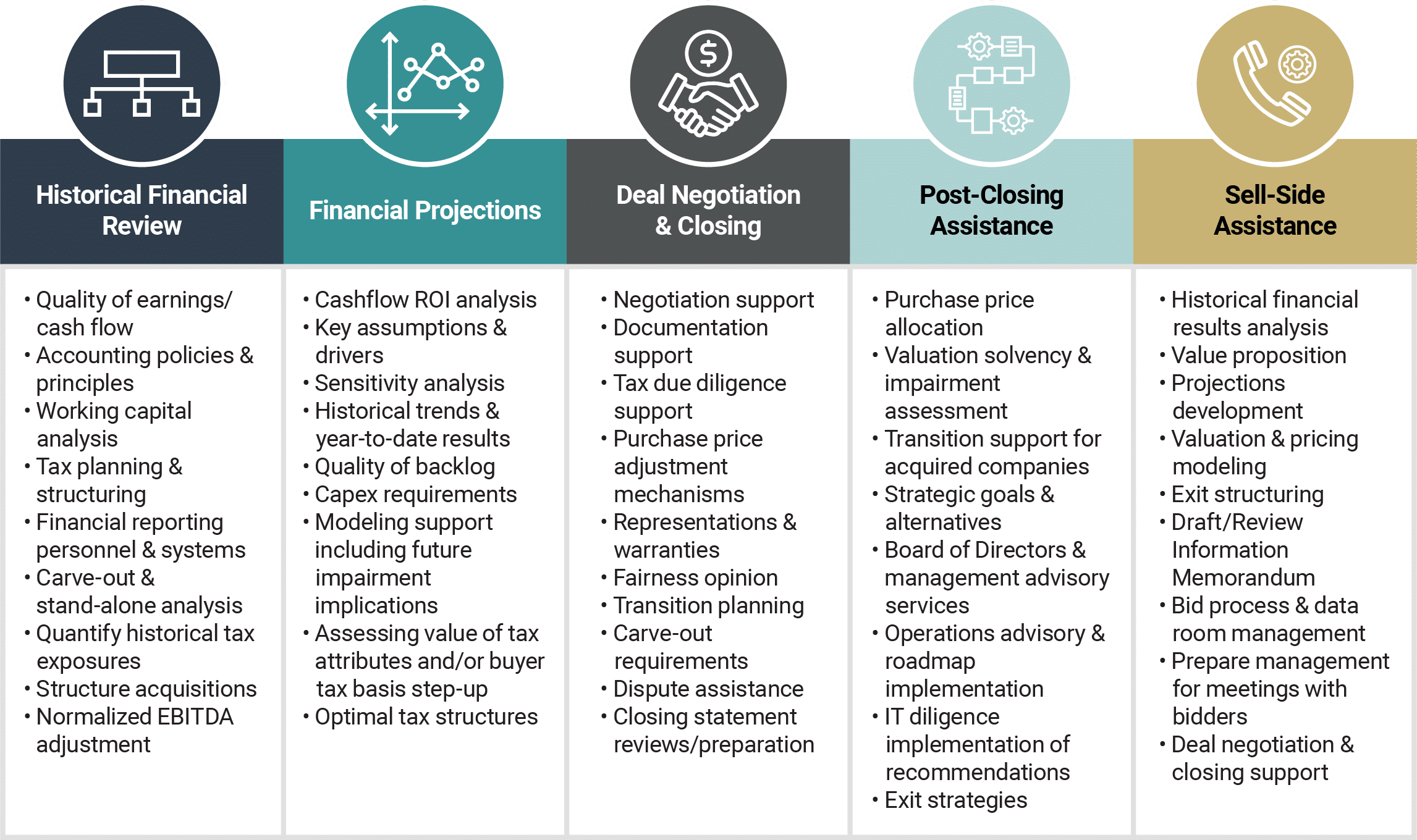

This step makes certain the business looks its ideal to possible purchasers. Getting the service's value right is important for a successful sale.Transaction consultants step in to assist by obtaining all the needed details organized, answering concerns from customers, and setting up brows through to the company's area. Transaction experts use their expertise to assist business owners take care of difficult arrangements, meet purchaser assumptions, and framework deals that match the proprietor's objectives.

Meeting legal policies is important in any kind of business sale. Deal consultatory solutions collaborate with legal professionals to develop and review agreements, contracts, and various other lawful documents. This reduces threats and ensures the sale complies with the regulation. The duty of transaction experts extends beyond the sale. They help local business owner in intending for their next steps, whether it's retirement, starting a new venture, or managing their newly found riches.

Deal consultants bring a wide range of experience and knowledge, guaranteeing that every element of the sale is managed skillfully. With strategic preparation, assessment, and arrangement, TAS helps local business owner achieve the highest feasible price. By making sure legal and regulative compliance and handling due persistance alongside other bargain group members, transaction advisors minimize possible threats and obligations.

Transaction Advisory Services Fundamentals Explained

By comparison, Big 4 TS groups: Job on (e.g., when a prospective customer is carrying out due diligence, or when a bargain is closing and the customer needs to incorporate the business and re-value the seller's Annual report). Are with fees that are not connected to the deal shutting successfully. Make fees per interaction somewhere in the, which is less than what financial investment banks gain even on "tiny offers" (yet the collection likelihood is likewise a lot higher).

, however they'll concentrate more on accountancy and evaluation and less on topics like LBO modeling., and "accounting professional just" subjects like trial balances and exactly how to stroll via events using debits and debts rather than financial statement modifications.

The Of Transaction Advisory Services

that show just how both metrics have actually altered based on products, channels, and consumers. to evaluate the precision of administration's past forecasts., including aging, supply by item, typical levels, and provisions. to determine whether they're entirely imaginary or rather believable. Professionals in the TS/ FDD groups may additionally talk to monitoring concerning everything above, and they'll create an in-depth record with their findings at the end of the procedure.The pecking order in Transaction Providers differs a little bit from the ones in investment financial and personal equity professions, and the basic shape looks like this: The entry-level role, anonymous where you do a great deal of data and economic analysis (2 years for a promo from right here). The next level up; similar job, but you obtain the more fascinating little bits (3 years for a promotion).

Specifically, it's difficult to obtain advertised beyond the Supervisor degree because couple of people leave the task at that phase, and you need to start revealing proof of your capability to create revenue to breakthrough. Let's start with the hours and way of living because those are easier to describe:. There are periodic late evenings and weekend break work, however absolutely nothing like the frantic nature of investment financial.

There are cost-of-living adjustments, so expect lower compensation if you're in a less expensive location outside major financial (Transaction Advisory Services). For all positions except Partner, the base pay makes up the bulk of the overall payment; the year-end incentive could be a max of 30% of your base pay. Often, the finest method to enhance your profits is to switch to a different company and bargain for a greater income and bonus offer

Transaction Advisory Services Things To Know Before You Buy

At this phase, you must simply stay and make a run for a Partner-level duty. If you want to leave, perhaps relocate to a client and do their valuations and due diligence in-house.The major problem is that because: You usually need to sign up with another Big 4 group, such as audit, and work there for a couple of years and after that move into TS, work there for a couple of years and after that move into IB. And there's still no assurance of winning this IB duty due to the fact that it depends on your area, customers, and the hiring market at the time.

Longer-term, there is likewise some threat of and because evaluating a firm's historical financial info is not specifically brain surgery. Yes, humans will always require to be entailed, yet with more advanced technology, lower head counts can possibly sustain customer engagements. That claimed, the Transaction Solutions group beats audit in terms of pay, work, and departure possibilities.

If you liked this write-up, you could be interested in reading.

The Best Guide To Transaction Advisory Services

Create advanced financial frameworks that help in identifying the real market price of a company. Provide advising job in relationship to organization evaluation to aid in bargaining and rates frameworks. Describe one of the most ideal type of the deal and the kind of consideration to employ address (cash money, supply, gain out, and others).

Carry out assimilation planning to identify the procedure, system, and business adjustments that might be Resources required after the deal. Set guidelines for incorporating divisions, modern technologies, and business processes.

Analyze the potential consumer base, market verticals, and sales cycle. The operational due diligence offers vital understandings right into the functioning of the firm to be gotten concerning risk analysis and worth creation.

Report this wiki page